IPO Readiness Workshop 2025: what it takes to go public

Preparing for an Initial Public Offering (IPO) requires more than financial readiness. At the recent IPO Readiness Workshop, handpicked Swiss scaleups gained ex...

Read more

As Swiss startups continue to grow and scale, accessing the public capital market becomes a critical milestone. Fabian Gerber, responsible for the Sparks IPO Academy at SIX, is at the forefront of this transition, helping scale-ups and fast-growing SMEs prepare for initial public offerings (IPOs). His role is crucial in demystifying the IPO process for Swiss startups, opening up new opportunities for these companies to tap into public capital and accelerate their growth trajectories.

The Swiss Stock Exchange is currently the third largest in Europe, with a free float market capitalization of EUR 1.6 trillion (as of June 2024). Around 250 companies of all sizes and sectors, including small and mid-caps, family businesses, and international giants benefit from being listed on the Swiss Stock Exchange. Fabian Gerber, responsible for the Sparks IPO Academy at SIX, plays a key role in preparing Swiss startups for successful public listings. He equips founders with the knowledge and tools to steer through the challenges of going public, with a particular emphasis on leveraging the Swiss stock market’s advantages. Through the Sparks IPO Academy, Fabian supports startups with knowledge of securing capital and scaling their businesses in the public markets.

The Swiss Stock Exchange is currently the third largest in Europe, with a free float market capitalization of EUR 1.6 trillion (as of June 2024). Around 250 companies of all sizes and sectors, including small and mid-caps, family businesses, and international giants benefit from being listed on the Swiss Stock Exchange. Fabian Gerber, responsible for the Sparks IPO Academy at SIX, plays a key role in preparing Swiss startups for successful public listings. He equips founders with the knowledge and tools to steer through the challenges of going public, with a particular emphasis on leveraging the Swiss stock market’s advantages. Through the Sparks IPO Academy, Fabian supports startups with knowledge of securing capital and scaling their businesses in the public markets.

The third edition of the Sparks IPO Academy came to an end in May. What did the 16 participating growth companies learn?

Over six months, they learned which stumbling blocks to avoid an IPO, in which partners need to be brought on board, and when and how to get the maximum visibility and reputation out of a stock market listing.

Who provided the training?

SIX does not work alone. Banks, international consulting firms, and renowned law firms are also involved in the academy and provide their capital market specialists.

The Swiss venture capital market is growing and growing, but to date, hardly any IPOs have taken place. The vast majority of exits are trade sales. Why is that?

There are certainly historical reasons for this. Swiss investors are traditionally rather risk-averse. But it is also a fact that the current situation is unsatisfactory from an economic point of view: our VCs invest billions in building up startups that are ultimately sold to large companies and then often move abroad.

Preparing for an Initial Public Offering (IPO) requires more than financial readiness. At the recent IPO Readiness Workshop, handpicked Swiss scaleups gained ex...

Read more

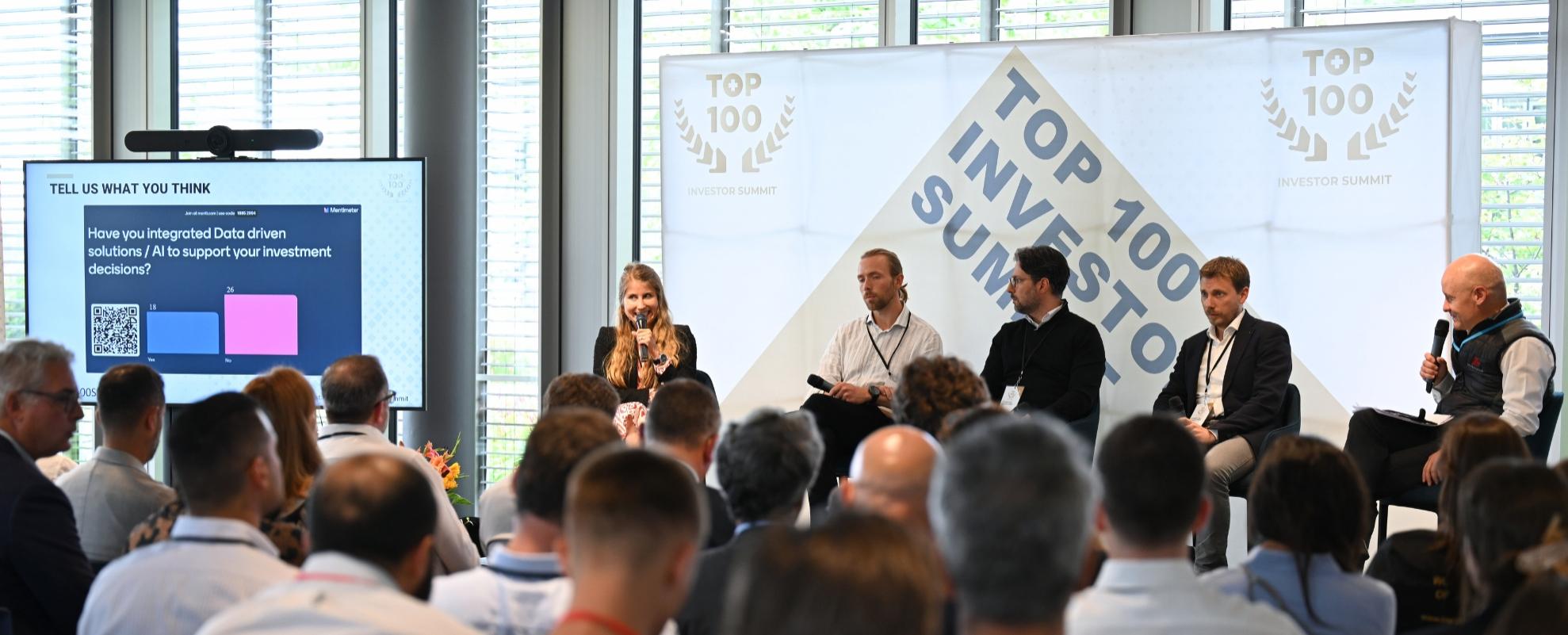

The eighth edition of the TOP 100 Investor Summit became a meeting ground for both entrepreneurs and investors. Handpicked TOP 100 startups that are raising a f...

Read more

The 14th edition of the TOP 100 Swiss Startup Award celebrated Switzerland's best startups according to a 100-person strong jury: DePoly (1st), Corintis (2nd), ...

Read more

Many success factors are critical to the viability and feasibility of an Initial Public Offering (IPO). The IPO Readiness Workshop provided insight into this co...

Read more

You have questions about Top100 or would like to exchange ideas with us? Feel free to contact me.

Jordi Montserrat Co-founder and managing partner jordi.montserrat@venturelab.swiss Jordi Montserrat on LinkedIn